Trade discount is the reduction in the retail price of a product that the manufacturer offers when selling to a reseller, rather than the end customer. This perk motivates the reseller to stock and promote the manufacturer’s product, fostering a beneficial business relationship.

Bulk purchases made by resellers come with a perk–the trade discount! So those of you who want to buy in bulk or meet certain conditions can get a grant from the original list price of the product in the form of a trade discount.

Such a discount takes place when the cost of goods or services is reduced at the time of purchase of large quantities of goods, providing benefits to those who shop in bulk. Businesses offer trade discounts to not only reduce their inventory costs but also motivate customers to make more purchases.

Table of Contents

What is a Trade Discount?

A trade discount is a discount deduction from a product’s list price provided by the product’s seller, typically the manufacturer or wholesaler, to the buyer, usually a retailer or another wholesaler. It is like a friendly nudge from the manufacturer to the reseller saying, “Hey, let’s make this deal even better for you.”

This discount serves as a strategy to incentivize the buyer to make a purchase, particularly in large quantities, thereby fostering a symbiotic relationship between the two parties. In the realm of financial management, a trade discount is a critical tool for boosting sales volume and enhancing cash flow. By offering a trade discount, the manufacturer or wholesaler encourages the retailer to stock and promote their product, ensuring greater market visibility and product turnover.

Key Points

Bulk sales are typically allowed and encouraged for a trade discount.

- All customers who are interested in purchasing bulk quantities can be accommodated with ease.

- Trade discount does not necessitate an entry in either the buyer’s or seller’s books of accounts.

- Prior to any transaction, the amount is always taken out. Therefore, it will not be accounted for on business ledgers.

- You’re generally given permission to purchase at the time of checkout.

- The amount of goods purchased and acquired frequently varies.

Purpose of Trade Discount

Purchasing in bulk offers resellers the opportunity to receive a trade discount from suppliers. The more goods purchased, the bigger the percentage of the price break; therefore, larger orders result in greater financial savings for those making wholesale purchases.

Trade discount is commonplace in the business world, as they allow companies to vary the price of their products according to each customer’s individual volume or stature. By utilizing these reductions from a company or manufacturer’s set cost, everyone can benefit from an advantageous deal!

This type of discount helps to ensure profit for all parties involved in the transaction. Trade discounts are an excellent method of reducing expenditures, but it’s essential to guarantee that the quality is on par with your expectations.

Through this process, investment banking and financial institutions may also be able to present a functional discount that allows customers to ultimately save on their purchases. This encourages customer loyalty by incentivizing them for continued purchases, as well as increasing sales when customers know they can receive bulk discounts.

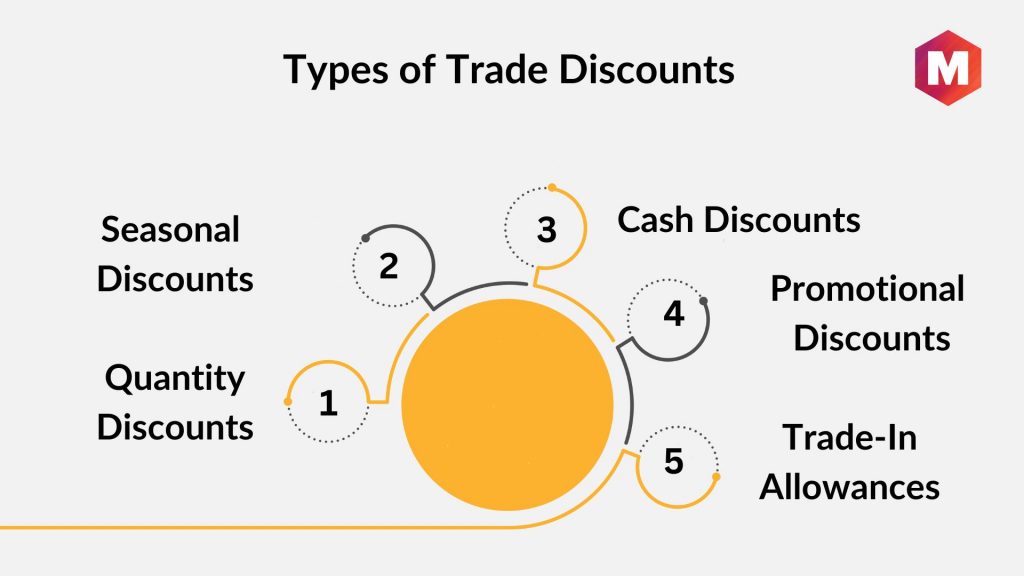

Types of Trade Discounts

1) Quantity Discounts

Quantity discounts are a widespread type of trade discount where the seller offers a reduced price to buyers who purchase goods in bulk. The principle is straightforward: the more you buy, the less you pay per unit. This encourages larger order quantities and facilitates inventory management.

2) Seasonal Discounts

Seasonal discounts are another type of trade discount typically offered during specific times of the year. For instance, retailers may offer discounts during off-peak seasons to stimulate sales and clear old inventory. This helps businesses maintain cash flow throughout the year and keep inventory fresh.

3) Cash Discounts

Cash discounts are incentives provided by sellers to buyers for immediate payment or payment within a specified period. These discounts, often a certain percentage off the total invoice, provide a win-win situation where businesses improve their cash flow and customers save money.

4) Promotional Discounts

Promotional discounts are temporary reductions in price to stimulate sales during a specific period. They’re generally part of marketing campaigns and can include tactics such as buy one get one free, or a percentage off for first-time buyers.

5) Trade-In Allowances

A trade-in allowance is a discount given for returning an old item when buying a new one. It’s a popular method used by businesses, particularly in the automotive and electronics industries, to encourage customers to upgrade to the latest models. This type of discount not only incentivizes repeat business but also helps manage product life cycles.

How Trade Discount Works?

Trade discounts are offered by businesses to customers who purchase their products or services in bulk. The customer’s total purchase amount determines the discount received; the more they buy, the greater the savings off of list prices. This type of price reduction is usually negotiated between the manufacturer and wholesaler/retailer before any orders are placed.

Once an agreement has been reached, the customer will see what is known as a published price or catalog price. This number is the base cost of the item before any discount. After applying the agreed-upon percentage, the reduced final amount is referred to as a discounted price and this is what customers end up paying for their order.

For example, a customer may pay $20 for an item that has a published price of $30. This indicates that the customer was able to secure a 33% discount on their order due to the trade discount agreement in place.

Formula

To determine the value, we can find it by multiplying the list price of a product by the discount rate.

Trade Discount = List Price x Discount Rate

- The Discount Rate refers to the percentage of discount that the seller provides on their products.

- The list price refers to the initial selling price set by the seller in the product catalog. It is also understood as catalog price.

How to Calculate the Trade Discount?

1) Finding the List Price of The Product

The list price, also known as the catalog price, is the original price of the product before any discounts are applied. You can usually find this price listed in the manufacturer’s catalog or on their website. It serves as the starting point for determining your trade discount.

2) Deciding the Discount Rate for the Product

The discount rate refers to the percentage of discount that the seller provides on their products. The rate is often negotiated between the seller and the buyer, and typically, the more substantial the order, the higher the discount rate. For instance, a business might offer a 10% discount on orders of 100 units, a 20% discount on orders of 500 units, and so on.

3) Determining the Trade Discount

To determine the trade discount, you’ll need both the list price and the discount rate. The formula is Trade Discount = List Price x Discount Rate. For example, if the list price of an item is $100 and the agreed-upon discount rate is 20%, the trade discount would be $100 x 20% = $20.

4) Calculating the Net Price

Finally, to calculate the net price – the amount the customer will actually pay – you subtract the trade discount from the list price. Using the same numbers as above, the net price would be $100 (list price) – $20 (trade discount) = $80. Therefore, the customer will pay $80 for an item originally priced at $100.

You can understand what is trade discount with more clarity with the help simple example given below –

Example of Trade Discount

If you’re the proud owner of a store and wish to purchase items from your supplier, you’ll be pleased to know that they offer an excellent trade discount percentage of 10%!

That means for every item bought, you only have to pay 90% of its original cost.

Accounting for a Trade Discount

The seller would not log the trade discount in its accounting records but only record revenue corresponding to the amount invoiced for the customer.

Noting both the retail price and a trade discount on an invoice to a reseller would cause an inflated gross sales amount in the income statement. If left unaddressed, readers of financial statements could mistakenly assume that there is higher sales volume than what actually exists, overlooking any deduction from the trade discount.

Differences Between a Trade Discount and Cash Discount

Trade discount is provided to persuade buyers to make larger orders, while cash discounts are early payment discounts that act as an incentive for them to pay promptly. A trade discount is typically a certain percentage of the suggested retail price, while cash discounts possess fixed amounts.

Let us have a look at both on different grounds

| Trade Discounts | Cash Discount |

|---|---|

| Trade discounts are based on the invoice value of the purchase and are typically given as a percentage of the invoice price. | Cash discounts are based on the list price of the goods and are typically given as a fixed dollar amount. |

| Trade discounts are offered to resellers who purchase large quantities of goods from a supplier. | Cash discounts are offered to customers who pay for their purchase within a certain period of time. |

| Trade discounts are typically recorded in the accounts receivable module of a company's accounting system. | Cash discounts are typically recorded in the accounting system as sales discounts. |

| The size of the trade discount is usually based on the volume of the purchase, with larger purchases resulting in bigger discounts. | The size of the cash discount is usually based on the list price of the goods, with larger purchases resulting in bigger discounts. |

| Trade discounts can also be tiered, with larger purchases getting a bigger discount than smaller purchases. | Cash discounts can also be tiered, with larger purchases getting a bigger discount than smaller purchases. |

Benefits

Trade discounts can help resellers save money on large purchases, and can also help suppliers increase sales by offering discounts to resellers. Unlimited access to the trade discount is another advantage of this method; it’s accessible by anyone who meets the criteria and wants to purchase wholesale goods.

The five notable benefits of trade discounts are as follows-

- Enables resellers to save money on large purchases

- Helps suppliers increase sales

- Trade discounts are typically recorded in the accounts receivable module of a company’s accounting system

- The size of the trade discount is usually based on the volume of the purchase

- Trade discounts can also be tiered

Limitations

Some of the negatives of trade discounts to take into consideration are as follows-

- It can make it difficult to compare prices

- Trade discounts can make it difficult to determine the true cost of goods

- Trade discounts can sometimes be difficult to track and manage

- Trade discounts may also result in lower profit margins for suppliers

Conclusion!

As a way to generate more sales and encourage customers, trade discounts are offered on the list price. This means that any purchases will be based upon the net price (list minus discount). It is important to note that trade discount is not recorded in books of account.

If you’re searching for a way to save money on the items you buy, then consider taking advantage of trade discounts – it’s an economical solution that could help cut costs! Ultimately, everyone benefits from this system, as both parties receive financial gain in exchange for a valuable service.

Trade discounts are an attractive option that allows customers to comfortably negotiate prices while still receiving beneficial quality products. It’s an excellent way to save money while still maintaining profit margins!

FAQs

Q1: Can you explain what a trade discount is and how it differs from other forms of discounts?

A: A trade discount is a percentage discount in the listed price of goods that suppliers offer to retailers. It differs from other types of discounts because it’s primarily used in B2B transactions, aimed at encouraging bulk purchases and incentivizing resellers to stock more of a supplier’s product. Unlike consumer discounts, trade discounts are not recorded in the financial books, and they’re applied before any other type of discount.

Q2: How trade discounts are determined by using different factors?

A: The calculation of trade discounts is generally based on the volume or quantity of goods purchased. The higher the volume, the greater the discount rate. It’s a tiered system, meaning that as the quantity of the purchase increases, so does the discount rate. However, it’s essential to note that the determination of these rates can also depend on other factors such as market competition, the relationship between supplier and reseller, and the demand for the product.

Q3: What strategies both suppliers and customers can utilize to negotiate trade discounts?

A: Effective negotiation for trade discounts requires open and honest communication between suppliers and customers. Suppliers can offer varying levels of discounts based on the volume of goods purchased or establish a tiered discount structure to incentivize higher order volumes. On the other hand, customers can push for higher discounts by promising to buy in larger quantities or offering to establish a long-term relationship with the supplier. Both parties should aim for a win-win situation to establish a sustainable business relationship.

Liked this post? Check out the complete series on Marketing