Let’s study the SWOT Analysis of P&G, a leading consumer product brand, to understand its strengths, weaknesses, opportunities, and threats.

Procter & Gamble (P&G) is a worldwide consumer products giant known for its innovation and brand building. It began as a tiny soap and candle firm in 1837 and has since expanded into a multinational conglomerate with well-known brands such as Tide, Pampers, and Gillette.

For over 180 years, P&G has relied on innovation, sustainability, and customer insights to fuel its success. Its commitment to decreasing its environmental impact and enhancing societal well-being highlights its position as a market leader and a socially responsible organization.

Overview of P&G

- Company type: Public

- Industry: Consumer goods

- Founded: October 31, 1837, 186 years ago

- Founders: William Procter, James Gamble

- Headquarters: Cincinnati, Ohio, U.S.

- Area served: Worldwide.

- Key people: David S. Taylor (Executive Chairman), Jon R. Moeller (President and CEO)

- Products: Cleaning agents, Skincare, Personal care

- Revenue: US$82.01 billion (2023)

- Operating income: US$18.13 billion (2023)

- Net income: US$14.65 billion (2023)

- Number of employees: 107,000 (2023)

- Website: www.pg.com

Table of Contents

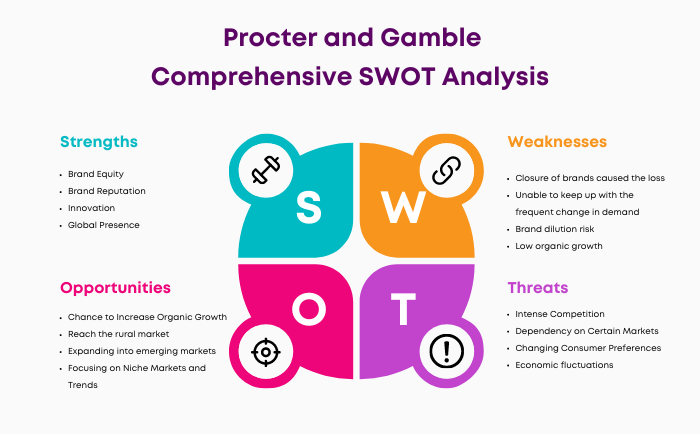

SWOT Analysis of Procter and Gamble

P&G’s Strengths

1. Brand Equity

Procter & Gamble (P&G) has a strong portfolio of globally recognized brands. These include well-known brands like Tide, Ariel, Pampers, Whisper, Gillette, Head & Shoulders, Herbal Essences, Pantene, Ambi Pur, Oral-B, Vicks, Olay, and Old Spice. This vast brand familiarity of leading brands within the P&G umbrella adds significantly to the company’s high brand equity. In 2023, Procter & Gamble’s net sales amounted to 82 billion U.S. dollars worldwide.

2. Brand Reputation

P&G’s reliable brand image amplifies its success. Thanks to intelligent marketing methods and a reputation for excellence, P&G routinely achieves high revenues and profitability, a significant accomplishment given the global market’s increasing competition. The company’s long-standing reputation for selling quality products and being a company built on ethics has contributed to its enduring success and unique culture.

3. Innovation

Innovation is at the core of P&G’s business strategy. With a long history of research and development, P&G’s incremental improvements to existing products and the creation of new ones keep them at the forefront of the consumer goods industry. The “P&G Good Everyday” project highlights the company’s unique marketing approach, which rewards customers for merely utilizing its products.

4. Global Presence

Known as a world-renowned multinational corporation, P&G’s reach spans 180+ countries. Furthermore, with around 65 distinct brands, each with its own product line, P&G’s massive global impact is unquestionable.

5. Automation

P&G uses automation to optimize resource allocation, save costs, and maintain consistent product quality throughout production. It also allows P&G to change output quickly in response to market demand.

6. Trained Labor Force

P&G understands the value of a skilled workforce. The company’s investment in extensive employee training has resulted in a talented, driven team of experts critical to its future success. The number of employees worldwide in 2023 was 107,000.

7. Advertising and Marketing

P&G’s inventive and captivating campaigns have set industry standards. The corporation frequently establishes marketing trends, which it supports with significant advertising investments.

8. Cost Management

P&G is committed to cost management and efficiency improvement. Keeping costs low enables P&G to maintain aggressive pricing while driving growth in a highly competitive consumer products business.

9. High Brand Awareness

Strong brand awareness is core to P&G’s success and has been deliberately cultivated through strategic celebrity endorsements. The company leverages celebrity partners’ extensive social reach to ensure its carefully customized brands reach all income levels.

10. Dealer Community

P&G promotes positive ties with its dealer community, which includes retailers, distributors, and dealers. This cooperation goes beyond simply selling their products to actively promoting them, increasing brand visibility, and driving sales growth.

P&G Weaknesses

1. Closure of brands caused the loss

While Procter & Gamble (P&G) has typically performed well, it has suffered losses due to the closure of various subsidiary brands under its jurisdiction. One great example is Pringles, which is now owned by Kellogg’s. This trademark termination indicates a decline in P&G’s product diversification and a loss of corresponding market shares, which is a significant negative.

2. Unable to keep up with the frequent change in demand

In the consumer goods industry, dynamic public demand is expected. P&G occasionally needs help responding quickly to these consumer demands and fluctuations. This inability to ensure product relevance exposes the organization to risk losing favor with its target consumers, indicating a severe operational strategy weakness.

3. Brand dilution risk

Managing a broad brand portfolio exposes P&G to the danger of brand dilution. Efforts to promote multiple brands across various segments may limit the attention on individual brands, reducing their competitiveness. For example, a well-known brand may lose value if its individuality merges with other brands in the portfolio.

4. Low organic growth

P&G is experiencing slowed organic growth due to consumer saturation and decreased innovation rates. This vulnerability is because the development of established brands depends primarily on acquiring new customers and retaining existing ones, implying that P&G should reconsider its marketing strategy to reverse this trend.

5. Slow decision-making due to the company structure

P&G’s structure, which includes several CEOs and managerial positions, frequently results in slow decision-making. The involvement of multiple stakeholders in reaching an agreement usually causes delays, making quick and responsive answers required in today’s fast-paced corporate climate.

6. Dependence on mature markets

P&G’s revenue comes primarily from developed markets such as North America and Western Europe. P&G’s net sales are approximately 50% from North America and Europe. As a result, any economic slowdown or stagnation in these regions directly influences P&G company’s performance and overall growth strategy, making it a significant weakness.

7. The potential negative impact of cost-cutting measures

P&G’s efforts to increase profitability through cost-cutting measures, such as reduced spending in research and marketing, may unintentionally limit business improvement and undermine its long-term competitive advantage. While cost savings are beneficial, sacrificing innovation and market presence could harm their market competitiveness.

8. Dependence heavily on external vendors

P&G relies heavily on third-party vendors for raw ingredients, packaging, and other components. This reliance exposes the corporation to supply chain interruptions, which could harm production and sales, making it a critical flaw in its business model.

9. Reliance on Traditional Ad Channels

P&G has typically invested significantly in television advertising. However, overreliance on traditional platforms is risky as the world moves toward digital ones. Therefore, P&G needs to change its marketing strategies to focus more on digital and social media.

P&G Opportunities

1. Chance to Increase Organic Growth

P&G could improve its organic growth by developing new ways to market its products and introducing new ones. By concentrating on unmet market needs and customer feedback, P&G can increase brand loyalty and market share.

2. Reach the rural market

Rural areas represent unexplored prospects for P&G, particularly in locations where the brand has not made a substantial mark. By tailoring products and marketing techniques to the demands of rural consumers, P&G can generate new revenue streams and strengthen its market presence.

3. Expanding into emerging markets

With growing middle-class populations and discretionary spending plans, P&G sees profitable potential in emerging areas such as Asia, Africa, and Latin America. Investing in these regions can help P&G benefit from expanding consumer goods demand.

4. Focusing on Niche Markets and Trends

By entering niche areas such as eco-friendly, organic, or natural products, P&G can meet the growing customer demand for sustainability. Adapting to these developing consumer goods market trends helps differentiate P&G from competitors and build a loyal consumer base.

5. Enhancing Digital and E-Commerce Presence

To keep up with the rise of online shopping, P&G needs to improve its internet presence and e-commerce options. Improving online platforms can boost sales and provide helpful consumer insights through data analysis.

6. Strengthening Innovation and Product Development

Continued investment in R&D can strengthen P&G’s commitment to innovation. Launching innovative products that adapt to changing consumer needs will help P&G maintain its market leadership and brand reputation.

7. Strategic partnerships and collaborations

Collaboration with startups, IT businesses, and research institutions can give P&G new technology, new product development options, and increased market reach. Such collaborations can create new opportunities for business growth and diversity.

8. Sustainability and Corporate Responsibility Initiatives

By concentrating on sustainability and corporate responsibility, P&G can improve its brand image, reduce environmental impact, and fulfill the expectations of environmentally concerned customers. This commitment can potentially support business growth and drive long-term consumer loyalty.

9. Personalization and customization

Exploring product personalization and customization enables consumers to personalize items to their demands, giving P&G a competitive advantage. This method can improve consumer happiness and brand loyalty.

10. Leveraging Data Analytics and Artificial Intelligence (AI)

Data analytics and artificial intelligence can help P&G gain insights into consumer behavior, optimize marketing activities, and increase supply chain management efficiency. This technology-driven strategy can result in better-informed decisions and operational efficiencies.

11. Investing in employee development and talent retention

Investing in its staff through development programs and retention measures is critical for P&G to sustain its competitive advantage. A talented and committed team can encourage innovation and help the company maintain its market position.

12. Mergers and Acquisition

Successful mergers and acquisitions can help P&G expand its market position, attract new customers, and gain access to new markets. Each purchase allows P&G to diversify its portfolio while utilizing efficiencies for greater market domination.

P&G Threats

1. Intense Competition

P&G competes in a highly competitive field, including established competitors like Unilever and Colgate-Palmolive and smaller, more agile competitors. The intense competition threatens to weaken P&G’s market position and pressure the corporation to lower prices to remain competitive, perhaps reducing profit margins.

2. Dependency on Certain Markets

Despite its global presence, P&G’s reliance on specific areas for significant revenue leaves it susceptible to economic downturns or political instability in these markets, which could substantially impact the company’s financial health.

3. Changing Consumer Preferences

The movement toward organic, natural, and eco-friendly products poses a challenge to P&G. Adapting to these consumer preferences is critical since a way needs to be found to improve product portfolio alignment, which may reduce the company’s market relevance.

4. Economic fluctuations

Consumer items are frequently the first to feel the impact of economic shifts. P&G is no exception, since it faces the risk of lower consumer spending and demand for its products during economic downturns, especially in established markets.

5. Generic and Private Label Brands

Consumers’ growing choice for cheaper alternatives, such as generic and private label goods, threatens P&G’s higher-priced offerings, harming the company’s market share and profitability.

6. Price of Raw Material

Price fluctuations in raw materials can significantly impact P&G’s manufacturing costs. A rise in these costs implies either an increase in product prices or a decrease in profit margins, which could be better from a strategic standpoint.

7. Buyer Control

The marketplace is full of major consumer goods companies competing for customer attention with promotions and discounts. Consumer loyalty is difficult to retain in this environment of severe competition, and brand switching is becoming an increasingly common phenomenon driven by various variables such as promotions, peer recommendations, and pricing.

8. Home Brands of Big Retailers

Retail giants are increasingly entering the consumer products market with in-house brands, which are frequently priced competitively. This approach can drive customers away from established brands like P&G and toward retailer-owned alternatives.

9. Supply Chain Disruptions

Given P&G’s global activities, the supply chain is vulnerable to disruptions caused by international conflicts, natural disasters, health crises, or trade restrictions. Any disruption may compromise the company’s capacity to supply items efficiently, potentially resulting in lost sales and increased costs.

10. Government Norms

Nationalistic policies, such as the “Make in India” campaign and similar programs worldwide, support local enterprises, which may disadvantage P&G when competing against domestic producers favored by such government policies.

Conclusion

Procter & Gamble (P&G), a dynamic consumer goods market sector leader since 1837, demonstrates persistence, innovation, and brand power. With a historic portfolio that includes Tide, Pampers, and Gillette, P&G has solidified its position via consistent brand equity, worldwide reach, and innovative marketing methods. However, the corporation faces obstacles such as adjusting to quick market changes, brand dilution threats, and increased competition.

Despite these challenges, P&G has numerous opportunities for growth by entering emerging markets, expanding its digital footprint, and focusing on sustainability efforts. P&G’s continuing growth and strategic adaptations indicate a future where it remains a giant prepared for additional innovation and global influence as it balances its strengths, weaknesses, opportunities, and challenges.

Liked this post? Check out the complete series on SWOT