Let’s explore the detailed SWOT Analysis of Chevron by understanding its strengths, weaknesses, opportunities, and threats.

The San Ramon, California-based Chevron Corporation produces oil, gas, refining, and chemicals worldwide. Established in 1879, it is one of the world’s largest integrated energy businesses, operating in North America, South America, Europe, Asia, and Australia. Chevron’s extensive operational base emphasizes its importance in meeting global energy needs.

Chevron is leading the energy industry toward sustainability by investing in renewable energy and low-carbon technology. With its outstanding financial performance, global reach, and commitment to environmental sustainability, the company is an essential actor in the future energy landscape.

Overview of Chevron

- Company type: Public

- Industry: Energy, Oil and gas

- Founded: September 10, 1879, 144 years ago as “Pacific Coast Oil Co.”

- Headquarters: San Ramon, California, U.S.

- Area served: Worldwide

- Key people: Mike Wirth (Chairman and CEO)

- Products: Gasoline, natural gas, and other petrochemicals

- Revenue: US$200.9 billion (2023)

- Operating income: US$29.58 billion (2023)

- Net income: US$21.37 billion (2023)

- Total assets: US$261.6 billion (2023)

- Total equity: US$160.9 billion (2023)

- Number of employees: 45,600 (December 2023)

- Website: chevron.com

Table of Contents

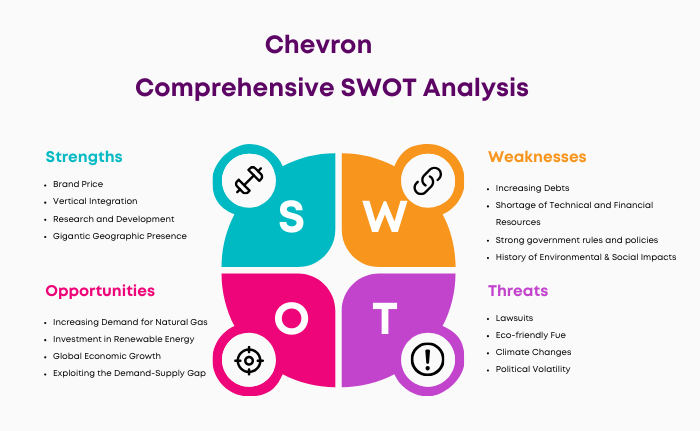

SWOT Analysis of Chevron

Chevron Strengths

1. Strong Brand Value

The brand value of the U.S. oil and gas company, Chevron Corporation stood at some 14.8 billion U.S. dollars in 2024. This makes it the sixth-largest oil corporation in the world, demonstrating its market power.

2. Robust Financial Position

Chevron has a solid credit rating and financial leverage to fund large projects, indicating its durability and growth potential. Chevron’s revenue for the quarter ending March 31, 2024, was $48.716B, and its net income for the quarter ending March 31, 2024, was $5.501B

3. Research and Development

Chevron develops environmentally friendly technology to improve sustainability and efficiency. Chevron’s research and development expenses for March 31, 2024, were $0.129B. Chevron saves operational expenses and gains a competitive edge with its solid patent portfolio and consistent R&D investment.

4. Gigantic Geographic Presence

Over 180 nations are served by Chevron. The key markets are the US, Nigeria, Angola, China, Russia, Canada, Brazil, and others. This broad presence lets Chevron capitalize on varied market possibilities and reduce regional risks.

5. Skilled Workforce

Employee knowledge and skills drive innovation and operational excellence across Chevron’s global operations. Total employees in 2024 were 45,600. Chevron’s success and strategic vision depend on its governance and management procedures, which are managed by a talented board and leadership.

6. Vertical Integration

Due to its vertically integrated business strategy, Chevron efficiently explores, produces, and markets natural gas and crude oil. Integrating helps Chevron to control quality and save money, setting it apart from competitors.

7. Sponsor of Automobile

Renowned auto alliances Renault, Nissan, and Mitsubishi support Chevron gasoline and lubricants. Chevron also sponsors professional auto racing teams and world vehicle championships, boosting its automotive brand visibility.

8. Lubricant and Gas Inventories

Chevron’s production hit a record 3.1 million barrels of oil equivalent per day last year, driven by 14% growth in the U.S. Chevron Corporation produced some 2.11 billion cubic feet of natural gas in the United States in 2023. Chevron has an ownership interest in around 36,547 productive oil wells in the United States.

9. Strong Brand Equity

A worldwide multinational energy corporation, with a strong brand identity, Chevron leads the market and is trusted by consumers.

10. Diverse Asset Base

The company’s oil, natural gas, and geothermal energy portfolio shows its diversification and capacity to use multiple energy sources.

11. Substantial Reserves

Chevron’s proven crude oil and natural gas reserves demonstrate its long-term sustainability and energy flexibility.

12. Operational Expertise

Chevron can solve industry problems and capture opportunities with its exploration, production, and refining capabilities.

13. Innovative Technologies

Modern technology helps Chevron find and generate energy resources more efficiently, improving production and lowering environmental impact.

14. Environmental and Safety Record

Chevron prioritizes safety and responsibility for the environment to reduce accidents and impact.

15. Strategic Alliances

Chevron shares risks and rewards in many joint ventures and partnerships, boosting operational efficiency, synergies and market reach.

16. Adaptation to Market Needs

Chevron’s flexibility in shifting its operational focus to natural gas shows its market responsiveness and strategic vision.

17. Renewable Energy Investments

Chevron invests in renewable projects like biofuels and hydrogen to support a sustainable energy future.

Chevron Weaknesses

1. Increasing Debts

As of Q1, 2024, Chevron’s debt is $21.835 billion, devoting a large amount of cash flow to interest payments.

2. Shortage of Technical and Financial Resources

Technical and financial constraints limit the company’s domestic and international growth and innovation.

3. Strong government rules and policies

Strict regional rules can reduce operating efficiency and hamper Chevron’s company.

4. History of Environmental & Social Impacts

Chevron is among the top 100 polluters of 0.9% of world carbon, gaining environmental criticism.

5. Legal Issues

Chevron has faced many legal issues, including EPA fines that can ruin its brand and cost more.

6. Reliance on Fossil Fuels

The company’s dependence on oil and gas earnings leaves it vulnerable in a greener energy market.

7. Regulatory and Legal Challenges

Chevron faces inspections and legal issues in numerous nations, highlighting the oil and gas industry’s strict regulations.

8. Volatile Commodity Prices

Revenue and profit margins vary due to oil and gas price fluctuations for Chevron.

9. Operational Risks

Geopolitically unstable regions put Chevron’s business continuity at risk.

10. High Capital Expenditure

Chevron struggles financially to maintain and grow its operations because of the oil industry’s high capital expenditure requirements.

11. Declining Oil Reserves

The cost of replenishing oil reserves during the worldwide decline threatens the long-term sustainability and expansion for Chevron.

12. Competition

Competitive pressure from traditional and renewable energy firms threatens Chevron’s market position and profitability.

13. Reputation Issues

Some environmental issues have damaged Chevron’s brand.

14. Potential for Asset Underperformance

Chevron’s financial results are always threatened by market volatility or geopolitical changes underperforming certain assets.

15. Carbon Transition Risk

Chevron must change its business model and asset portfolio to adapt to the worldwide shift from carbon-based fuels, a strategic risk.

16. Workforce Management

Managing a diverse global workforce in operational consistency, regulatory compliance, and cultural integration is difficult.

17. High Debt Levels

The company’s high debt limits flexibility and may hinder future investment and growth.

18. Climate Change Pressure

The growing attention to climate change from stakeholders may drive Chevron to make costly operational changes.

19. Aging Infrastructure

Aging infrastructure requires significant modifications and upkeep to reduce operating hazards and maintain efficiency.

Chevron Opportunities

1. Increasing Demand for Natural Gas

With natural gas consumption expected to rise, Chevron has a significant chance of entering this market. The global trend toward greener energy sources favors Chevron’s natural gas expansion.

2. Investment in Renewable Energy

Chevron’s large solar and wind power investments demonstrate its commitment to renewable energy leadership. This strategy strengthens Chevron’s energy portfolio and puts it at the forefront of sustainable energy solutions.

3. Global Economic Growth

Chevron can scale its operations as economic expansion and fuel dependence drive global energy demand. This helps Chevron expand its market share and meet the energy needs of an expanding population.

4. Exploiting the Demand-Supply Gap

Chevron can benefit from energy market needs as the gap between demand and supply widens. Chevron can address these objectives by using its resources and skills and growing its market share and influence.

5. Gas Market Development

Natural gas consumption is rising as the world moves to cleaner energy. Chevron’s significant gas operations position it to develop in this sector, reinforcing its commitment to greener energy sources and boosting market growth.

6. Digital transformation

Chevron can improve research, distribution, and operations by adopting digital transformation. Innovative technologies promise efficiency, cost savings, and a competitive edge in a fast-changing energy landscape.

7. Carbon Capture Technologies

By investing in carbon capture and storage, Chevron can cut its carbon footprint considerably. This supports global sustainability and creates new carbon credit market revenue.

8. Strategic Partnerships

By working with established and new energy companies, Chevron can access new technologies and markets. These collaborations help it increase and diversify its energy portfolio.

9. Expansion in Emerging Markets

Chevron can enter emerging economies with rising energy needs. Chevron can reach new customers and build these businesses by entering these markets.

10. Hydrogen Economy

Chevron can explore hydrogen production, distribution, and related technologies due to the growing interest in hydrogen as a clean energy source. This matches the global shift toward renewable energy.

11. Enhanced Oil Recovery

Innovative oil recovery methods can extend Chevron’s oil reserves’ lifespan. This optimizes resources and strengthens Chevron’s sustainability.

12. Electric Vehicle Charging Infrastructure

Chevron could diversify by investing in or working with EV charging station suppliers as the EV industry grows. This strategy would place Chevron in the changing transportation energy landscape.

13. Energy Storage Solutions

Renewable energy integration has increased the need for effective energy storage technologies. Chevron can capitalize on this opportunity by investing in or partnering with energy storage businesses.

14. Bioplastics, biochemicals

Chevron can provide renewable biochemicals and bioplastics for companies seeking sustainable alternatives. This expands its products and reduces environmental effects.

15. Geothermal Energy

Chevron’s drilling and infrastructure expertise could help it enter geothermal energy. This reliable and sustainable energy source expands Chevron’s renewable energy portfolio.

16. Acquisitions

Chevron can improve its technology and market position by acquiring smaller companies or startups with innovative technologies. These strategic acquisitions can boost company development and innovation.

17. Environmental Services

Chevron might offer environmental consultation or remediation using its industry experience. Diversification would boost revenue and reinforce its environmental responsibility.

18. Energy Efficiency Solutions

Chevron may develop by targeting industries and customers with energy-efficiency solutions and services. This technique supports global energy conservation and improving energy efficiency.

19. Transition to Blue and Green Hydrogen

As a clean fuel, hydrogen allows Chevron to produce blue and green hydrogen. Chevron would lead the clean energy transition and capitalize on market demands with this strategy.

Chevron Threats

1. Lawsuits

Different legislation and norms in different markets may cause Chevron legal issues. These lawsuits may damage the company’s operations and reputation.

2. Eco-friendly Fuel

If demand for eco-friendly fuels rises, Chevron’s extensive use of non-renewable energy threatens it. This reliance could cost the organization a lot if not addressed.

3. Climate Changes

Energy needs will increase carbon dioxide emissions in production and upstream operations, which Chevron must manage. Strict environmental restrictions, expenses, and public perception require Chevron to reduce greenhouse gas emissions.

4. Political Volatility

Oil and gas companies are political issues because of their importance in international relations. Chevron, a worldwide company, may be attacked by instability in politics.

5. Intense Competition

Chevron may face competition from old and developing competitors in a business where technology and profit stability determine competitiveness.

6. Regulatory and Environmental Policies

Chevron works in an environmentally regulated business. These restrictions, especially climate change ones, can limit operations and increase expenses.

7. Fluctuating Oil Prices

Due to global geopolitics and changing supply and demand, oil price volatility can hurt oil and gas firms like Chevron.

8. Alternative Energy Sources

Renewable energy sources, including wind, solar, and electric vehicles, may reduce market demand for Chevron’s oil and gas industry.

9. Risks

Conflicts, legislative changes, and asset nationalization might hamper Chevron’s activities in politically risky locations.

10. Competitive Landscape

Chevron faces large oil and gas firms and renewable energy startups. This broadened competitive landscape may pressure Chevron’s market share and profitability.

11. Legal and Litigation Risks

Present and future environmental incidents might cost Chevron legal action, financial penalties, and reputational damage.

12. Supply-chain disruptions

Pandemics, geopolitical conflicts, and natural calamities could devastate Chevron’s supply network.

13. Cybersecurity Threats

Chevron’s global footprint and reach exposes it to cyberattacks that endanger data security and operations.

14. Public Perception and Social Responsibility

Chevron may suffer from consumer boycotts or protests due to public disapproval of fossil fuel firms.

15. Technological Disruption

The rapid advancement of energy technologies may render some Chevron assets and operations outdated.

16. Resource Access

Due to laws, competition, and space limits, Chevron may struggle to find new oil and gas deposits.

17. Decarbonization and Transition Risks

As the world transitions to a low-carbon economy, Chevron’s economic model may struggle, impacting its market position.

18. Shareholder Activism

More shareholders want corporations to address ESG issues. This activism may affect Chevron’s plans and decisions.

19. Financial Risks

Economic downturns, shifting interest rates, and volatile market circumstances pose significant financial risks to Chevron.

Conclusion

Chevron Corporation combines tradition and innovation in the global energy scene with its century-plus history. As an oil and gas giant, its substantial brand value, global presence, and financial performance demonstrate its essential function in energy supply. Environmental, legal, and oil price swings threaten Chevron.

Sustainability and renewable energy present Chevron as both a challenge and an opportunity to redefine its legacy. Chevron can address its shortcomings and challenges and capitalize on its strengths and possibilities to create a sustainable future by adopting innovation, investing in renewable energy, and leading in carbon capture technologies.

Liked this post? Check out the complete series on SWOT