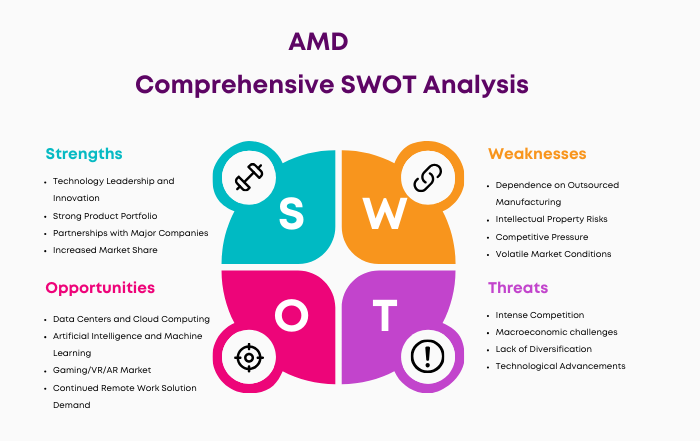

Let’s explore the SWOT Analysis of AMD by understanding its strengths, weaknesses, opportunities, and threats.

AMD, a semiconductor giant founded in 1969, is known for its superior computer and graphics technology. AMD’s Ryzen™, Radeon™, and EPYC™ series demonstrate its dedication to innovation and performance. This makes AMD a viable opponent in a tech giant-dominated industry.

AMD’s research and development strategy has helped the company stay ahead in the fast-changing technological market. AMD advances its products and pushes the market by forming strategic partnerships and collaborations and acquiring companies, making it a key player in digital computing.

Overview of AMD

- Company type: Public

- Founded: May 1, 1969, 54 years ago

- Founder: Team led by Jerry Sanders

- Headquarters: Santa Clara, California, United States

- Area served: Worldwide

- Number of employees: 26,000 (2023)

- Revenue: US$5.5 billion (Q1, 2024)

- Operating income: US$36 million (Q1, 2024)

- Net income: US$123 million (Q1, 2024)

- Website: amd.com

Table of Contents

SWOT Analysis of AMD

AMD Strengths

1. Technology Leadership and Innovation

AMD continually leads in technology and innovation. The first 64-bit, dual-core, and 7nm x86 processors were among its innovations. Their enormous annual R&D spending maintains their creative status.

2. Strong Product Portfolio

AMD offers a wide range of applications for its desktop, laptop, server, graphics card, and semi-custom processors. This variety creates many revenue streams by reducing market sector dependence.

3. Global Footprint

AMD has more than 50 sites in 31 countries. AMD’s global presence allows it to serve customers worldwide and respond to changing market conditions.

4. Intellectual Property

AMD’s many patents and IP rights boost its competitiveness. AMD has 11492 patents globally, out of which 7923 have been granted. Of these 11492 patents, more than 72% patents are active.

5. Financial Performance

AMD’s financial health has improved because of its increased market share and operational efficiency. There was $5.5 billion in sales in the first quarter of 2024, with a gross margin of 47% and $36 million in operating income, as per the latest financial statement shared by the company.

6. Partnerships with Major Companies

AMD benefits from partnerships with tech giants. Being Microsoft and Sony’s game console chip provider helps maintain demand.

7. Increased Market Share

Due to its competitive products, AMD has gained significant market share in the CPU and GPU industries. The favorable reception of Ryzen CPUs, Radeon GPUs, and server-grade EPYC processors has affected Intel-dominated data centers.

8. Skilled Leadership

Skillful Leadership at CEO AMD’s turnaround is due to Dr. Lisa Su. Her innovation and strategic collaboration strategy improved AMD’s market position and financial success.

9. Competitive Pricing

Due to its pricing approach, AMD is a popular alternative for consumers and businesses seeking high-performance hardware at low prices.

10. Focus on Energy Efficiency

AMD’s efforts to improve CPU energy efficiency benefit the environment and influence consumer and business decisions.

11. Product Performance

AMD’s Ryzen and EPYC CPUs are a strong competitor to Intel in terms of performance.

12. Graphics and Computing Solutions

AMD’s Radeon line competes with NVIDIA, and the ATI acquisition boosts its market share.

13. Innovation, R&D

With consistent R&D investment, AMD can maintain its products new and competitive advantage. AMD research and development expenses for the March 31, 2024 quarter were $1.525B.

14. Manufacturing Strategy

AMD’s fabless manufacturing strategy, using TSMC, reduces costs.

15. Brand Reputation

AMD is well-known in PC gaming and enthusiasts circles for its performance and affordability.

16. Customer Loyalty

AMD has a devoted client base that values its price-performance proposition.

17. Diversification

To lessen market dependence, AMD diversifies into desktop, mobile, server, and graphics processors.

18. Supply Chain Improvements

AMD’s agile supply chain allows them to respond faster to market developments and demand swings.

19. Adaptability

AMD’s quick adoption of cloud computing and AI is noteworthy.

20. Leadership

Dr. Lisa Su has rebounded AMD, positioning the business well against competitors.

21. Operational Efficiency

Due to its lean organizational structure, AMD can make decisions and innovate faster than bureaucratic competitors.

22. Supply Chain Resilience

AMD’s supply chains have survived chip shortages.

23. Community Engagement

AMD’s community engagement efforts, such as AMD Cares, promote a favorable company image and increase consumer trust and loyalty.

AMD Weaknesses

1. Dependence on Outsourced Manufacturing

AMD manufactures chips using TSMC, not its factories. This dependence could cause production issues or capacity limits during peak demand or worldwide chip shortages, delaying product introductions or reducing market availability.

2. Intellectual Property Risks

AMD faces intellectual property conflicts in the tech-heavy semiconductor sector. Despite a strong patent portfolio, litigation risks can lead to costly legal fights and commercial disruptions.

3. Competitive Pressure

AMD faces stiff competition from Intel and NVIDIA, which have stronger marketing, distribution, and financial resources. AMD may need help to grow and gain market share because to this fierce competition.

4. Volatile Market Conditions

The semiconductor industry is cyclical. Therefore, AMD’s demand fluctuates owing to economic swings, consumer purchasing changes, and quick technological advancements, making planning and stability difficult.

5. Limited Mobile Presence

AMD needs to catch up on smartphone technology growth by having a small presence in the growing mobile processor industry, dominated by Qualcomm and Apple.

6. Dependence on a Few Key Customers

AMD relies on a few big clients, like Sony and Microsoft for their game consoles. This restricted customer base is vulnerable if clients change their sourcing strategy or demand drops.

7. PC market dependence

AMD’s fortunes depend on the PC market despite diversification efforts. Any decline in this area due to changing consumer tastes or technology could hurt AMD’s finances.

8. Lower Brand Recognition

AMD’s brand may need to be stronger than Intel’s, making market share acquisition and customer engagement difficult impacting its semiconductor industry competitiveness.

9. Smaller market share

AMD needs to catch up with Intel regarding market share, which may limit its capacity to negotiate with suppliers and recruit customers.

10. Financial Stability Concerns

AMD has grown in revenue, but its history of losses poses financial concerns. AMD may need financial stability to spend on R&D to compete with tech giants.

11. Manufacturing Constraints

AMD struggles to meet demand due to manufacturing difficulties. Supply chain issues have delayed product introductions and lowered consumer satisfaction, indicating operational inefficiencies.

12. Key Supplier Dependence

Using TSMC for chip fabrication risks supply disruptions and quality difficulties, which could hinder AMD’s ability to deliver products on schedule and meet quality standards.

13. Price Sensitivity

AMD’s competitive pricing approach may lead to price sensitivity and reduced profits. AMD’s profitability may suffer in markets where Intel engages in pricing wars.

14. Research and Development Costs

AMD must invest thoroughly in R&D to compete with Intel and NVIDIA. AMD could lose market share in fast-changing tech environments if it falls behind in innovation.

15. Economic Sensitivity

AMD’s performance is affected by the health of the PC market, which fluctuates with the economy. Economic downturns could impact AMD’s product demand and income.

16. Product Recalls and Defects

Significant product faults or recalls can cost AMD a lot and damage its reputation, affecting consumer trust and brand loyalty.

17. Scalability Challenges

AMD’s lesser scale than industry heavyweights makes it harder to rapidly expand manufacturing to meet demand spikes, restricting its market responsiveness and growth options.

18. Marketing/Branding

AMD may need help creating a strong brand and attracting consumers in consumer-centric markets due to the lower marketing spending of Intel and NVIDIA.

19. Customer Concentration Risks

AMD’s dependence on a few key customers makes it vulnerable to changes in its needs or strategy, which might hurt revenue.

20. International Operations Challenges

AMD’s global operations are subject to exchange rate changes and geopolitical concerns, damaging earnings and operational planning and complicating international business strategy.

21. Narrower Product Line

AMD has a less broad product selection than Intel, which could limit its ability to offer full solutions to major clients or benefit from cross-selling opportunities in specific areas.

22. Patent Expiration

Despite severe competition, AMD must invest in R&D to innovate when previous patents expire to maintain its technological edge and market position.

AMD Opportunities

1. Data Centers and Cloud Computing

AMD’s EPYC server CPUs have huge data center opportunities due to increased data consumption and cloud service demand. AMD may improve its market share in this sector by utilizing its performance and pricing advantages.

2. Artificial Intelligence and Machine Learning

AI and ML demand lots of computing power. It benefits AMD’s powerful CPUs and GPUs. AMD may gain market share in these growing sectors by increasing product development for these applications.

3. Gaming/VR/AR Market

AMD GPUs benefit from the growing gaming industry and VR/AR technology. Immersive technology’s performance demands may help the company.

4. Continued Remote Work Solution Demand

The pandemic’s unexpected turn to remote work has increased demand for PCs and laptops. If this trend continues, AMD’s product portfolio may sell well.

5. Collaborations and partnerships

AMD can expand its market share and revenue with tech partnerships. AMD’s market position may improve with automotive or IoT partnerships.

6. Expanding Mobile Processor Market

AMD can capitalize on the growing mobile device market, especially smartphones and tablets, where Intel has failed.

7. Emerging markets

AMD may expand its global market share and base in new economies as tech adoption rises, boosting product growth.

8. High-Performance Computing (HPC)

AMD’s EPYC and Radeon Instinct product lines benefit from the growing demand for supercomputing capability for scientific research, gaming and professional applications for weather simulation.

9. Automotive Industry

AMD’s automotive offerings may expand due to the growing need for sophisticated processors in electric vehicles and self-driving technology.

10. Internet of Things

AMD can expand its semiconductor portfolio to capitalize on the IoT device market.

11. Software Development

Investing in software capabilities that complement AMD’s hardware could boost its competitive edge by improving developer tools and ecosystem relationships.

12. Education Sector

AMD can expand its education services by providing cost-effective solutions to educational institutions through e-learning developments.

13. Supply Chain Optimization

Optimizing the supply chain could help AMD reduce costs and improve product delivery, improving customer satisfaction and profit margins.

14. Custom Chip Solutions

AMD can generate new revenue and meet client needs by supplying custom chips for several sectors.

15. Acquisitions

AMD may seek strategic acquisitions of smaller tech companies or innovative startups to enhance its tech capabilities and product suite.

16. Sustainability Initiatives

AMD may gain brand loyalty and attract environmentally conscious customers by manufacturing more energy-efficient products and adopting sustainable practices.

17. Work from Home Culture

AMD products benefit from the global shift toward remote work, which boosts demand for powerful home computer solutions.

18. Intellectual Property Utilization

AMD can boost earnings by licensing or developing new products from its vast IP portfolio.

19. Edge Computing

As interest in edge computing grows, AMD can offer the best options for processing data near its source, a crucial benefit in businesses requiring low-latency graphics processing units.

20. Telecommunications

With the rapid implementation of 5G technology, network equipment updates are vital, making AMD’s solutions more relevant and benefiting from infrastructure advancements.

21. Blockchain

AMD can capitalize on the blockchain revolution using GPUs for cryptocurrency mining and decentralized applications.

AMD Threats

1. Intense Competition

AMD faces tough competition from Intel, Nvidia, and Qualcomm, which have deeper R&D, marketing, and strategic funds. AMD’s market share growth is hampered by Intel’s domination.

2. Macroeconomic challenges

Economic downturns reduce AMD product demand and cause currency exchange rate volatility. These problems may hurt AMD’s revenue growth and endanger its worldwide operations.

3. Lack of Diversification

Due to its CPU and GPU focus, AMD’s business is more vulnerable to industry shifts and consumer preferences. AMD’s risk distribution and growth potential in AI and IoT are limited by this exclusive concentration.

4. Technological Advancements

Rapid technological improvements could make AMD’s products need to be updated. Quantum computing shows that AMD must innovate ahead of industry trends.

5. Legal and regulatory challenges

Global operations put AMD in challenging legal and regulatory situations. Data privacy and intellectual property requirements require substantial efforts and can be costly.

6. Global Chip Shortage

AMD’s income and market position are affected by the shortage of semiconductors.

7. Intellectual Property Disputes

Patent disputes and intellectual property challenges can cost AMD a lot and limit its product sales.

8. Price Wars

AMD may have to lower prices due to aggressive pricing from competitors, hurting profit margins.

9. Exchange Rate fluctuations

Since AMD operates globally, currency rate variations, especially a stronger U.S. dollar, might hurt its financial results.

10. Regulatory Changes

Changes in international trade policies and regulations could disrupt AMD’s supply chain or access to major markets, causing logistical and financial issues.

11. Cybersecurity Threats

Technology companies like AMD are vulnerable to hacks that could compromise sensitive data and intellectual property, lowering security and market confidence.

12. Shifts in Consumer Preferences

Technology and consumer tastes can quickly reduce demand for AMD’s products, requiring ongoing innovation and market reevaluation.

13. Market Saturation

Market saturation in some CPU and GPU sectors may limit AMD’s growth prospects.

14. Dependence on Key Customers

AMD’s revenue depends on major customers like console makers and cloud providers. Losing one or more of these customers could hurt its finances.

15. Fabrication Plant Limitations

AMD relies on third-party foundries for chip fabrication, which might limit product availability due to operational limits and capacity issues.

16. Overdependence on the PC Market

Despite diversification attempts, AMD’s business model relies on the PC industry, which is threatened by cyclical demand and other computing devices.

17. Shift to Alternative Technologies

AMD must adapt and innovate to survive in the CPU and GPU sectors, which quantum computing may disrupt.

18. Tariffs and Trade Tensions

Trade wars, especially between the U.S. and China, might affect AMD’s supply chain, market reach, and cost structures.

19. Environmental Regulations

Global environmental rules could raise operational and manufacturing costs, forcing AMD to invest heavily in sustainability.

20. Fluctuating Demand for Gaming Hardware

AMD’s performance in the gaming hardware industry is vulnerable to game release cycles and economic trends.

21. Energy Costs and Efficiency

AMD must invest more in energy-efficient technologies to stay competitive in a greener future.

Conclusion

Finally, AMD’s history in the semiconductor industry shows that it is a resilient, innovative, and strategic corporation. AMD has built a niche via research and development, smart alliances, and a wide product range despite tough competition and a quickly changing tech sector. AMD’s focus on energy efficiency, customer loyalty, and ability to adapt to technological and market changes position it for growth.

Due to outsourced production, intellectual property threats, and fast-paced tech innovation, AMD must be flexible and forward-thinking. Innovation, strategic vision, and resilience are crucial in the ever-competitive technology industry. AMD is looking forward to data centers, AI, and expanding markets.

Liked this post? Check out the complete series on SWOT