Let’s explore the SWOT Analysis of Axis Bank by understanding its strengths, weaknesses, opportunities, and threats.

One of India’s largest private sector banks, Axis Bank offers a wide range of financial products and services to smaller businesses and significant organizations. Its network, founded in 1993, includes hundreds of branches and ATMs nationwide and abroad. Digital banking has advanced the bank’s innovation and client service.

Axis Bank has grown to incorporate retail, corporate, and international banking activities by employing cutting-edge technology to improve banking efficiency and user experience. The bank’s CSR programs promote sustainability and community development, reflecting its growth-with-social responsibility philosophy. Axis Bank has achieved much in its 20-year history and seeks to transform banking in the digital age.

Overview of Axis Bank

- Industry: Financial services

- Founded: 3 December 1993; 30 years ago as UTI Bank

- Headquarters: Axis House, Mumbai, Maharashtra, India

- Number of locations: 5377 (March 2024)

- Key people: Amitabh Chaudhry (MD & CEO), Shri Rakesh Makhija (chairperson)

- Revenue: Rs. 137,989 crore (US$17 billion) (2024)

- Operating income: Rs. 39,356 crore (US$4.9 billion) (2024)

- Net income: Rs. 26,386 crore (US$3.3 billion) (2024)

- Total assets: Rs. 1,518,239 crore (US$190 billion) (2024)

- Total equity: Rs. 155,512 crore (US$19 billion) (2024)

- Number of employees: 104,333 (as of March 2024)

- Website: www.axisbank.com

Table of Contents

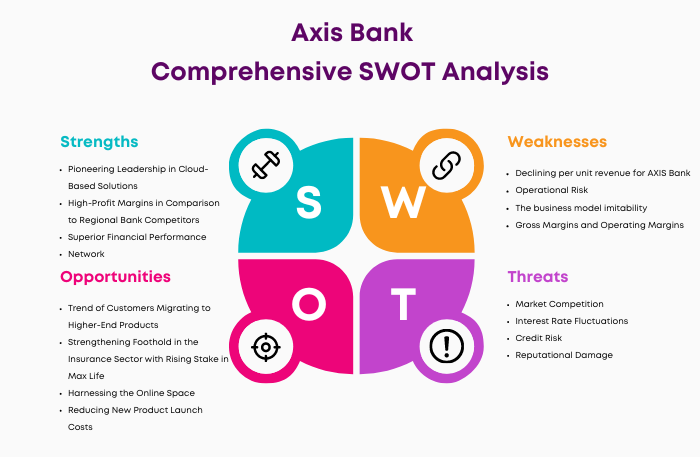

SWOT Analysis of Axis Bank

Axis Bank – Strengths

1. Pioneering Leadership in Cloud-Based Solutions

Axis Bank utilizes Amazon and Google to secure customer data on a private cloud and host selected services on a public cloud. This hybrid system lets the bank handle unanticipated client traffic increases thanks to cloud scalability.

This cloud capabilities allowed 20,000 staff to work remotely, saving Axis Bank during the COVID-19 pandemic. Cybersecurity investments have helped Axis Bank avoid cloud security breaches. Despite its traditional banking reputation, Axis Bank’s tech-forward approach makes it a digital leader.

2. High-Profit Margins in Comparison to Regional Bank Competitors

Profitability is difficult for the retail banking’ sector; however, Axis Bank outperforms its regional bank competitors. Despite falling profitability, the bank has remarkable profit margins. Its FY2023 Profit after tax was INR 9,580 crores, with an increase of 26%.

3. Superior Financial Performance

Axis Bank consistently performs well. The bank’s rising income, profits, and assets demonstrate its market durability and financial health. Net Interest Income for FY24 grew 16% YOY to INR 49,894 crores from INR 42,946 crores. Operating profit grew by 16% to INR 37,123 crores from INR 32,048 crores in FY23. Core operating profit grew by 10% to INR 35,393 crores from INR 32,291 crores in FY23. Net Profit for FY24 grew 160% to INR 24,861 crores from INR 9,580 crores in FY23.

4. Network

It added 125 branches during the quarter and 475 in FY24, bringing its total network of 5,377 domestic branches and extension counters spread across 2,963 centers. This is up from 4,903 domestic branches and extension counters spread across 2,741 centers as of March 31, 2023.

The bank had 16,026 ATMs and cash recyclers nationwide as of March 31, 2024. As of March 31, 2024, the Bank’s Axis Virtual Center has over 1,590 Virtual Relationship Managers across six venues.

5. Diverse Product Mix Success

To serve Regional bank customers, Axis Bank offers many products. The bank’s extensive product mix meets customer needs, creating the best bank with an attractive value offer that utilizes its competitive advantage.

6. Robust Brand Recognition

Axis Bank is well-known among Regional Banks. The bank can charge more than competitors due to its strong brand image and reputation. As of May 2024, Axis Bank has a market cap of $42.99 Billion.

7. Market Leadership Position

Axis Bank leads the regional banking industry due to its expansion and performance. It is the 3rd largest private sector bank in India. This leading edge helps the bank grow new products quickly and succeed.

Axis Bank – Weaknesses

1. Declining per unit revenue for AXIS Bank

Regional Banks’ profitability is falling due to competition. Per-unit revenue at AXIS Bank has fallen. A thorough examination of the bank’s product value offerings is needed to absorb this impact. How other banks maintain per-unit income amid industry problems could lead to solutions.

2. Operational Risk

AXIS Bank faces operational risks from human errors, system breakdowns, fraud, and internal inefficiencies. For instance, fraud can undermine a bank’s reputation and consumer trust. The bank should enhance internal controls and invest in cutting-edge security to reduce these dangers.

3. The business model imitability

Competition can easily copy AXIS Bank’s business model. AXIS Bank must establish a broad, integrated platform model that brings together suppliers, vendors, and end users to offer unique services that set it apart in the Regional bank business to overcome this problem.

4. Gross Margins and Operating Margins

Gross and operating margins could be improved in AXIS Bank’s financial statement. A strategic financial management plan targeting these segments is needed to increase performance due to future challenges.

5. Liquidity Risk

Liquidity mismanagement can delay payments, affecting AXIS Bank’s stability and operations. Therefore, sound risk management is needed to preserve liquid resources.

6. Declining market share with increasing revenues

Despite rising revenues, AXIS Bank’s market share is growing slower than regional banks. AXIS Bank must carefully evaluate changes in the financial sector and adjust its strategies to grow in this fast-paced business.

7. High cost of replacing industry experts

AXIS Bank staff are knowledgeable about the bank’s operations. Significant resources can be expensive and difficult to replace in the present market. Thus, encouraging essential contributors to stay and use their skills is crucial.

8. Disappearance of niche markets and local monopolies

AXIS Bank is struggling as the specialty market and local monopoly chances evaporate. The traditional client network that AXIS bank once succeeded at is now failing. This requires a fresh way to reach new markets.

9. Human Resource Management

Effectively managing a considerable workforce is challenging. Employee management and development mistakes can affect operational efficiency. According to recent assessments, AXIS Bank must invest more in human resources to keep its employees happy, motivated, and productive.

Axis Bank- Opportunities

1. Trend of Customers Migrating to Higher-End Products

Recently, people have chosen premium goods and services. Premium brand Axis Bank will benefit from this trend. Good customer service develops bank loyalty and trust, especially in its bottom sector. This migration boosts Axis Bank’s profits and reputation. Premium-segment consumers receive individualized, high-value items, improving personal banking and service.

2. Strengthening Foothold in the Insurance Sector with Rising Stake in Max Life

Axis Bank’s planned purchase of 12.99% of Max Life Insurance allows it to co-promote and influence the insurer’s commercial objectives. Life insurance is expanding at 3.7% penetration and 11% growth due to COVID-19 health awareness. Axis Bank’s lengthy relationship with Max Life helped it capitalize on rising health insurance demand. Axis Bank’s diverse business boosts earnings with complementary products and services.

3. Harnessing the Online Space

As online service adoption rises, Axis Bank can innovate and increase its digital offerings. More clients choose online banking for its ease and efficiency. Therefore, Axis Bank can develop new online services to boost its digital banking position. This aligns with the technology adoption trend and allows for new consumer segments who prefer Internet and banking services.

4. Reducing New Product Launch Costs

Partnering with third-party retailers and using specific social networks helps cut product launch costs. This method lets Axis Bank test new products in a controlled setting before launching them. This reduces financial risk and gathers client feedback to improve the product. Keeping innovation and cost efficiency in mind is strategic.

5. Rapid Expansion of Economy

Axis Bank can expand internationally at an unprecedented rate due to the US economy’s rapid recovery. With its competitive market experience, Axis Bank may use the current momentum to grow in the US. The bank may reach new customers and vary its revenue streams with this expansion plan.

6. Accelerated Technological Innovations

Thanks to rapid technological progress, banking can offer a wide range of products and services. These advances can help Axis Bank develop new products or improve existing ones. This boosts operational efficiency and matches consumers’ demands for smarter, faster, and more efficient banking.

Axis Bank- Threats

1. Market Competition

Public, private, and multinational banks fight for power in India’s banking system. This makes it difficult for Axis Bank to maintain or increase its market share and profit margins. Competition drives pricing wars, aggressive marketing, and ongoing innovation, stretching the bank’s operations and profits.

2. Interest Rate Fluctuations

The central bank’s monetary policy governs interest rates, which affect Axis Bank’s Net Interest Margins (NIM), a key profitability indicator. A rise in interest rates could increase borrowing costs, lower loan demand, and lower the bank’s interest profits, lowering NIM and profitability.

3. Credit Risk

Credit risk from borrower defaults threatens Axis Bank. NPA growth threatens the bank’s financial stability and investor and stakeholder confidence. A high NPA ratio might hurt the bank’s stock performance and credit rating, limiting its expansion and capital market access.

4. Reputational Damage

Axis Bank’s reputation can suffer in the fast information and social media age. Dissatisfied customers and legal and ethical crises can damage customer confidence and loyalty. Reputational harm can cost companies and make it hard to attract new consumers.

5. Fluctuations in Foreign Exchange Rates

With international operations, Axis Bank is subject to currency exchange rate fluctuation. Unfavorable swings might cause financial losses while returning overseas company profits or during cross-border transactions. Wise monetary management of foreign banks is needed to protect the bank’s bottom line from currency concerns.

6. Cybersecurity Risks

As banking moves online, cybersecurity risks grow. Phishing, data breaches, and system hacks can cost businesses money and damage customer trust in investment banking itself. Advanced cybersecurity is essential for banks like Axis to protect against emerging cyber threats.

7. Technological Disruptions

Fintech enterprises and non-banking financial institutions use cutting-edge technology to offer innovative financial services, challenging the banking model. By providing accessible, user-friendly solutions, these disruptors can considerably attract Axis Bank’s client base, forcing it to speed up its digital transformation to stay competitive.

8. Regulatory Changes and Compliance

Understanding banking regulations takes time and effort. Unexpected regulatory changes or noncompliance with banking licenses can result in fines, lawsuits, and reputational damage. Axis Bank must stay watchful and adaptable to avoid punishment and comply with changing regulations, especially in digital transactions and financial innovations.

9. Economic Instability

Financial instability, including inflation and depreciation of currencies, can hurt banks. Consumer spending and savings decrease under such situations, affecting banking demand. Like its peers, macroeconomic swings can hurt Axis Bank’s development and finances.

10. Global Economic Conditions

Axis Bank’s international operations are exposed to global economic concerns like geopolitical instability and trade disputes. External causes can disrupt the bank’s investments and campaigns abroad, highlighting the need for a well-diversified and strategically positioned international portfolio to manage the risks of global economic instability.

11. Climate and Environmental Risks

Growth in climate change and sustainability brings problems and opportunities. Companies with severe environmental impacts are under examination, causing banks to rethink their lending practices and long-term viability. The move to a more sustainable economy requires Axis Bank to balance financial and environmental goals.

12. Changing Consumer Preferences

Consumers want convenience, personalization, and digital-first banking. The change to mobile banking, online transactions, and sustainable banking demands Axis Bank to innovate and adapt. To be competitive in a fast-changing market, the bank must adapt to these changing preferences for acquiring and keeping clients.

Conclusion

In summary, Axis Bank is a strong force in the Indian banking industry thanks to its innovative use of digital technologies, varied sources of income, and stable financial results. Despite its strong brand recognition and market power, it faces several obstacles, including operational risks, competitive pressures, and the always-changing preferences of consumers.

Axis Bank must invest in technology, improve its cybersecurity protocols, and develop new products to handle these challenges and capture new opportunities. Doing this will strengthen its standing in the competitive banking industry and create the path for a sustainable and customer-focused future. The bank’s future course will be shaped by its capacity to adjust and prosper in these developments, confirming its dedication to quality and innovation in the digital era.

Liked this post? Check out the complete series on SWOT

hai arun update ur marketing knowldge than only u servy in this world

Dear L.S prakash, please give constructive comments. If you feel theres something more to be added in the article then please do so rather than criticising.