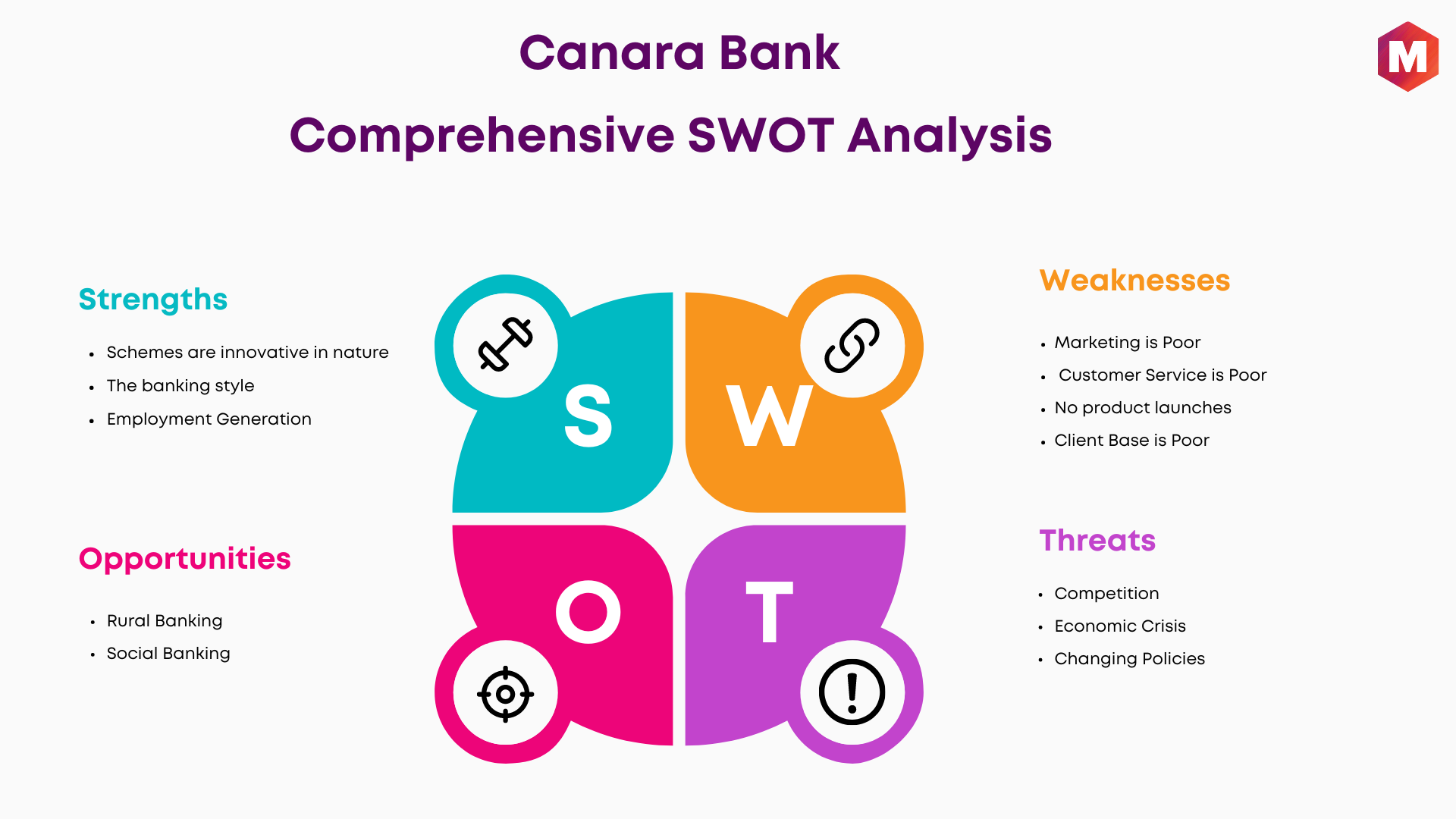

Let’s explore the SWOT analysis of Canara Bank by understanding its strengths, weaknesses, opportunities, and threats.

Canara Bank is a public-sector bank owned by the government of India and is one of the largest banks in the government’s kitty. The bank’s headquarters is located in Bangalore, Karnataka. The bank started in the year 1906 in Mangalore. It is one of the oldest banks in the country. It has more than 6,000 bank branches in India. It is present in other countries as well.

Overview of Canara Bank:

- Industry: Banking, Financial services

- Founded: 1906, 118 years ago

- Headquarters: Bengaluru, India

- Number of locations: 9,518 Branches | 13,423+ ATMs (2023)

- Key people: Vijay Srirangan (Non-executive Chairman), K Satyanarayana Raju (MD & CEO)

- Revenue: ?139,165 crore (US$17 billion) (2024)

- Operating income: ?29,711 crore (US$3.6 billion) (2024)

- Net income: ?14,782 crore (US$1.8 billion) (2024)

- Total assets: ?1,535,018 crore (US$180 billion) (2024)

- Owner: Government of India (62.93%)

- Number of employees: 86,919 (March 2022)

- Capital ratio: 13.36%

- Website: canarabank.com

Table of Contents

SWOT Analysis of Canara Bank

Strengths of Canara Bank

1. Schemes are innovative

The schemes introduced by the bank are very innovative. It provides loans at a meager rate for people living in rural areas and hence, helps uplift the living standard in rural areas by helping farmers. It collaborated with UNEP to launch a solar loan scheme.

2. The banking style

Compared to other public banks in India, Canara Bank articulates the best practices and creates a good banking experience for the customers, leading to the better brand image in the customers’ minds.

3. Employment Generation

The banks employ more than 40000 people in India and hence generate employment for many people.

Weaknesses of Canara Bank

1. Marketing is Poor

Being a public bank in India, the marketing focus is significantly low, and hence, this leads to low publicity in the market despite offering good banking facilities and experience to the customers. The bank does not have a marketing department that focuses on increasing the awareness of the bank in the market.

2. Customer Service is Poor

The banking industry in India is very competitive, and customer service is one thing that uniquely differentiates the bank. Canara Bank has not been able to deliver good customer service. Customers are generally unhappy with how staff handles the queries and imparts services at the banks. Also, the online banking facilities are not very well developed.

3. Client Base is Poor

The bank does not have a good customer base of high-income groups. Thus, the revenue generation is from low-income groups, which do not increase the bottom line of the bank, and hence, the growth is slow.

Opportunities of Canara Bank

1. Rural Banking

The bank can explore more aspects of rural banking as the majority of Indians live in rural areas, and hence, by fulfilling their banking needs, the bank can grow its revenue.

2. Social Banking

In the era of social media, banks are adopting social channels and catering to customers’ needs using an additional challenge and saving their time to visit physical banks.

Threats of Canara Bank

1. Competition is Increasing from Private Sector Banks

Private sector banks are coming up with innovative investment schemes, hence taking the share of retail customers.

2. Economic Crisis

Due to the financial crisis, the customers are not saving money in the banks, and hence, this reduces the liquidity of banks, and they cannot operate smoothly due to lack of cash.

3. Changing Policies

Banking policies are subject to the rules and regulations of RBI, and hence, any changes from RBI directly impact the bank’s operations.

Conclusion

A pillar in India’s banking sector, Canara Bank offers an extensive network of ATMs and branches, as well as a rich history. Its most notable assets are its innovative programs, strong banking practices, and substantial employment generation. Nevertheless, the bank faces various obstacles, including a restricted clientele among high-income groups, substandard customer service, and inadequate marketing.

The enormous potential of India’s rural population, leveraging social media, and expanding rural and social banking are all opportunities. Nevertheless, the economic crises, changing policies, and increasing competition from private sector institutions present substantial threats. To remain competitive and expand its market presence, Canara Bank must enhance its marketing efforts, improve its customer service, and adapt to the changing banking landscape to flourish.

Liked this post? Check out the complete series on SWOT